cryptocurrency tax calculator uk

Crypto tax calculator software lets the users connect or import their cryptocurrency transaction data mainly the purchase price sale price and the crypto tax calculator tool automatically. Check if you need to pay tax when you sell cryptoassets.

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

Crypto Tax Calculator Select a country Sort out your tax nightmare Dont struggle with Excel.

. This site aims to provide a simple overview of UK tax rules for newcomers to bitcoin and cryptocurrency. If youre a basic rate Income Tax payer ie with taxable earnings of 12571-50270 a year youll pay Capital Gains Tax of 10 then 20 on gains that take you above. Tax year 202223 Your situation How did you make.

HMRC has released solid guidance on how cryptocurrencies are taxed in the UK sending the clear message to crypto investors that they need to calculate and report their. For example if you buy 1 BTC at 1000 and a second BTC for 3000 your average cost would be. Capital Gains Tax calculator Quickly know how much Capital Gains Tax you owe on your profits from property shares crypto and more.

Create your free account now. Crypto bitcoin united-kingdom tax cryptocurrency tax-calculator hmrc cryptoasset capital-gains tax-calculations cryptotax tax. Youll need to know the price you bought and sold your crypto for as well as your taxable income for the.

The HMRC uses an average cost basis to calculate the cost on capital gains. Although all information provided has been verified in communication with HM. Select the tax year you would like to calculate your estimated taxes.

Select the appropriate tax year. Enter your taxable income minus any profit from crypto sales. Use Crypto Tax Calculator.

Enter Your Personal Details. Check if you need to pay tax when you receive cryptoassets. To check if you need to pay Capital Gains Tax you need to work out your gain for each transaction you make.

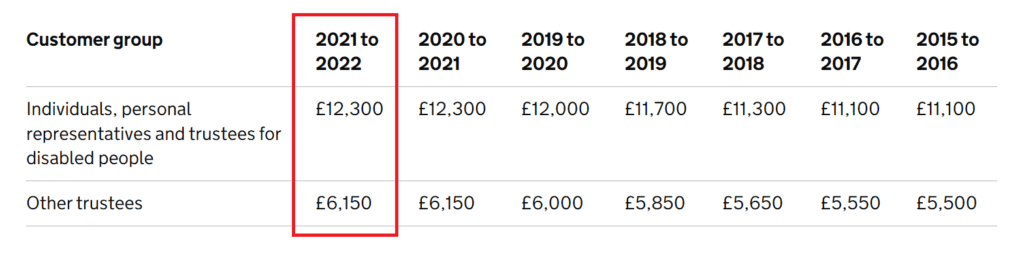

Crypto-currency tax calculator for UK tax rules. Enter your taxable income. This means that for the 20212022 tax year Capital Gains Tax rates for cryptocurrencies in the UK are.

Configurable tax settings Covers NFTs DeFi DEX trading Integrates. 0 if the entire capital gain is below the tax-free allowance 10. Use our crypto tax calculator below to.

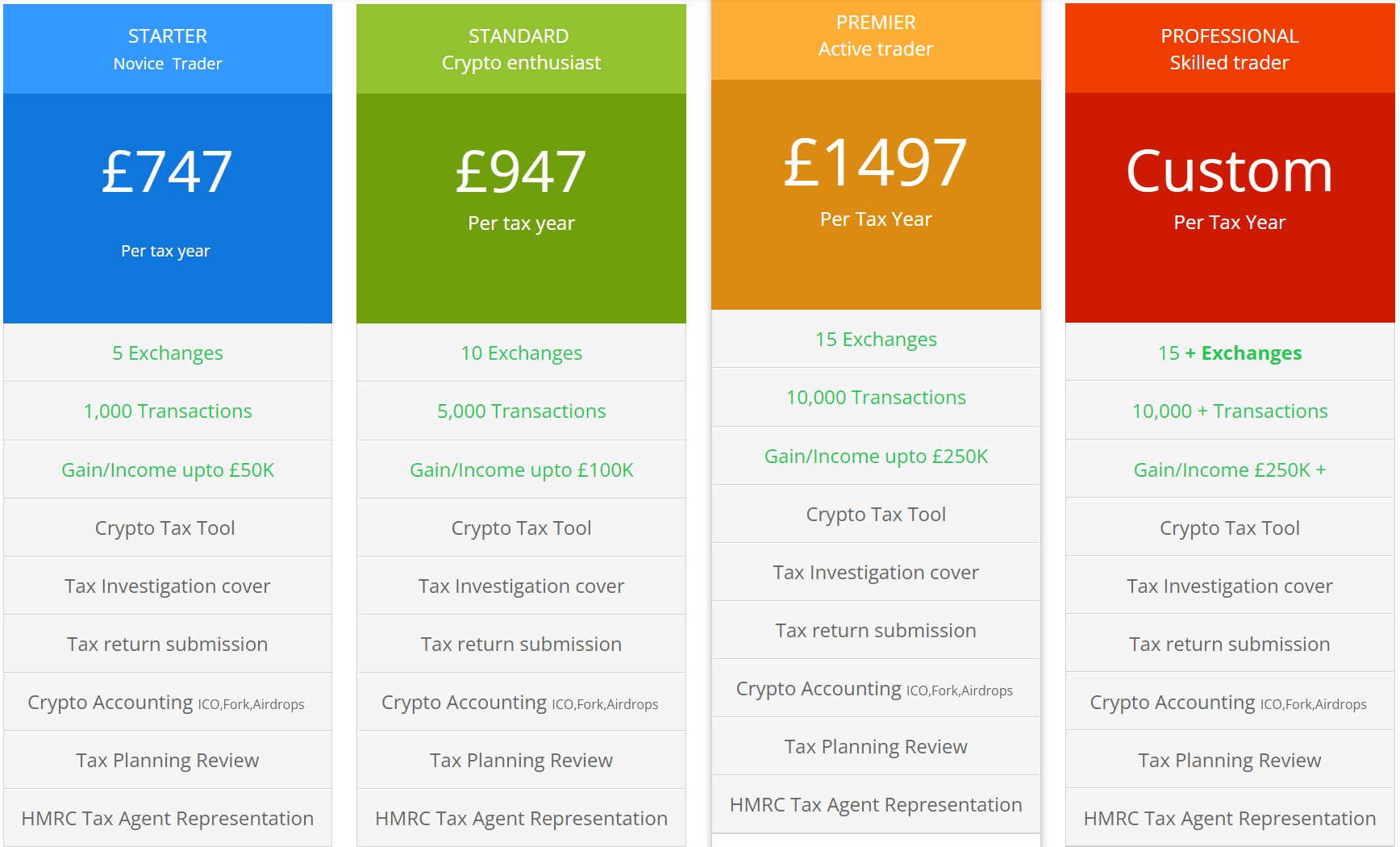

File your crypto taxes in UK Koinly helps UK citizens calculate their crypto capital gains. This means you may owe taxes if your coins have increased in value whether youre using them as an investment or like you would cash. You can also generate an Income report that shows your income from Mining Staking Airdrops Forks.

Choose your tax filing status. You can estimate what your tax bill will look using the calculator below. It takes less than a minute to sign up.

The way you work out your gain is different if you sell tokens within. Select your tax filing status.

Calculating Crypto Taxes In Uk W Share Pooling Koinly

Taxes On Cryptocurrency Uk Archives The Bitcoin Manual

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

How To Calculate Your Crypto Taxes For Your Self Assessement Tax Return Recap Blog

The Definitive Guide To Uk Crypto Taxes 2022 Coinledger

Best Bitcoin Tax Calculator In The Uk 2021

11 Best Crypto Tax Calculators To Check Out

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

How To Legally Avoid Uk Crypto Taxes Koinly

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

6 Best Crypto Tax Software S 2022 Calculate Taxes On Crypto

Best Bitcoin Tax Calculator In The Uk 2021

A Beginner S Guide To Filing Cryptocurrency Taxes In The Us Uk And Germany